Insurance Asia Fundamentals Explained

Wiki Article

The Main Principles Of Insurance Advisor

Table of ContentsThe smart Trick of Insurance Account That Nobody is DiscussingHow Insurance Code can Save You Time, Stress, and Money.Things about Insurance QuotesThe Insurance Commission DiariesNot known Facts About Insurance

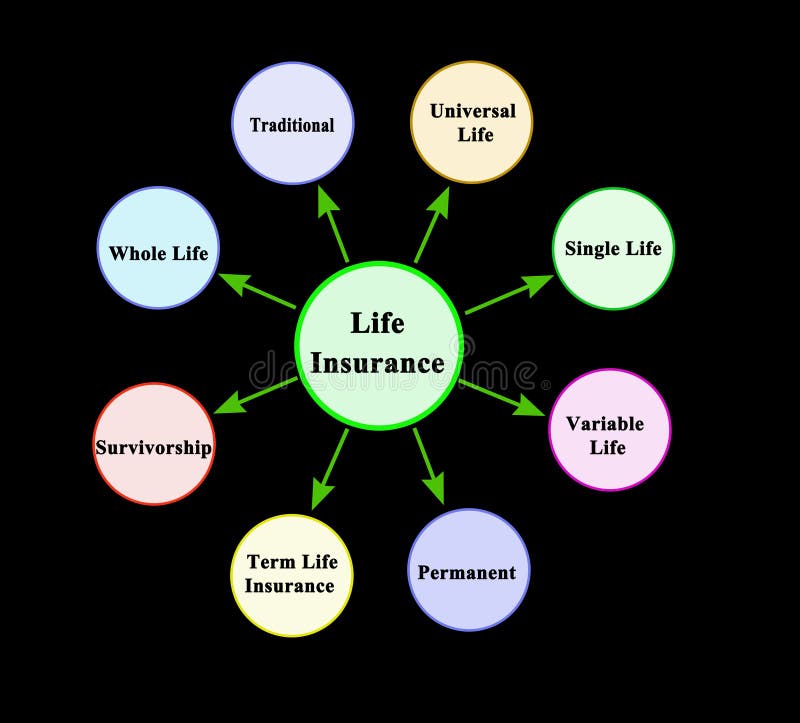

Other types of life insurance policyGroup life insurance is normally supplied by employers as part of the business's office advantages. Premiums are based on the group in its entirety, instead of each individual. Generally, employers use basic protection for cost-free, with the alternative to acquire additional life insurance policy if you require extra coverage.Mortgage life insurance covers the present balance of your home loan as well as pays out to the lender, not your family, if you die. Second-to-die: Pays after both policyholders pass away. These plans can be made use of to cover estate taxes or the treatment of a reliant after both insurance holders pass away. Regularly asked inquiries, What's the best kind of life insurance to get? The most effective life insurance coverage plan for you boils down to your needs and budget. Which kinds of life insurance policy deal adaptable costs? With term life

insurance coverage and entire life insurance policy, premiums normally are taken care of, which implies you'll pay the very same quantity each month. The insurance coverage you need at every age varies. Tim Macpherson/Getty Images You require to get insurance to secure on your own, your family, and your wide range. Insurance coverage could save you hundreds of bucks in the event of an accident, ailment, or catastrophe. Health and wellness insurance and also auto insurance policy are needed, while life insurance, homeowners, tenants, and handicap insurance policy are encouraged. Get started for free Insurance policy isn't one of the most exhilarating to consider, but it's neededfor protecting on your own, your family, as well as your wide range. Mishaps, illness, as well as calamities happen all the time. At worst, events like these can dive you right into deep financial mess up if you do not have insurance policy to fall back on. Plus, as your life modifications(state, you obtain a new work or have an infant)so needs to your coverage.

All about Insurance Commission

Listed below, we've clarified briefly which insurance coverage you ought to highly consider purchasing at every stage of life. Once you leave the functioning globe around age 65, which is typically the end of the lengthiest policy you can acquire. The longer you wait to buy a policy, the greater the ultimate cost.If somebody else counts on your earnings for their financial wellness, after that you possibly require life insurance policy. Even if you don't have dependents, there are other reasons to live insurance policy: exclusive pupil funding financial debt, self-employment , or a family-owned business. That's less than the cost of a gym membership to shield your family's financial security in your lack. The most effective life insurance coverage policy for you relies on your spending plan as well as your financial goals. There are two major types of life insurance policy plans to select from: irreversible life and term life. When your dependents are no more counting on you for financial support. Insurance policy you need in your 30s , House owners click to find out more insurance coverage, House owners insurance is not needed by state legislation. If you have a home mortgage, your loan provider will certainly need property owners insurance to secure the investment.Homeowners insurance coverage shields the house, your items, and offers responsibility protection for injuries that take place on your building.If you important link market your home and also return to renting out, or make various other living setups. Family pet insurance coverage Animal insurance might not be considered an essential, unless. insurance expense.

The smart Trick of Insurance That Nobody is Talking About

you wish to pay out $8,000 for your pet's surgical treatment. Some plans also cover regular veterinarian brows through and also vaccinations, and many will reimburse approximately 90%of your veterinarian expenses. This is where long-lasting care insurance or a crossbreed policy enters play. For individuals that are aging or disabled and require aid with daily living, whether in a nursing residence or with hospice, long-lasting treatment insurance coverage can aid carry the exorbitant prices. Long-lasting treatment is pricey. Most Americans will certainly need lasting care at some factor throughout their retirement. You are mosting likely to Spain for the very first time. insurance commission. You have a stop-over at Abu Dhabi. Your very first flight obtains postponed. You miss out on the second trip and obtain stuck. You are driving to work like every various other day. The roadway has oil spill.

Some Known Facts About Insurance Quotes.

-If, nonetheless, you survive the term, no cash will certainly be paid to you or your household. -Your household receives a specific amount of money after your death.-They will likewise be qualified to a bonus offer that typically builds up on such amount. Endowment Policy -Like a term policy, it is additionally valid for a specific period.- A lump-sum amount will be paid to your family members in the event of your death. Money-back Policy- A Read Full Article certain percent of the amount assured will be paid to you regularly throughout the term as survival advantage.-After the expiration of the term, you get the balance amount as maturation proceeds. -Your family members gets the entire amount assured in case of death throughout the plan duration. The quantity you pay as costs can be deducted from your complete gross income. This is subject to an optimum of Rs 1. 5 lakh, under Section 80C of the Earnings Tax Act. The premium amount utilized for tax obligation reduction need to not exceed 10 %of the sum guaranteed.What is General Insurance policy? A general insurance policy is a contract that offers monetary payment on any loss various other than fatality.

Unknown Facts About Insurance Advisor

The insurance company cleared up the expense directly at the garage. Your health insurance policy dealt with your therapy expenses. Your cost savings, thus, continued to be unaffected by your sudden ailment. As you can see, General Insurance policy can be the response to life's various problems. Yet, for that, you require to choose the right insurances from the myriad ones readily available. What are the sorts of General Insurance coverage available?/ What all can be insured? You can get practically anything and also whatever insured. Pre-existing illness cover: Your medical insurance cares for the treatment of diseases you might have before getting the medical insurance policy. Accident cover: Your health and wellness insurance can spend for the clinical therapy of injuries triggered due to crashes and problems. Your health and wellness insurance can likewise help you save tax obligation.Two-wheeler Insurance coverage, This is your bike's guardian angel. It's comparable to Automobile insurance coverage. You can not ride a bike or scooter in India without insurance policy. Similar to cars and truck insurance coverage, what the insurance firm will pay depends upon the sort of insurance policy and also what it covers. 3rd Party Insurance Policy Comprehensive Cars And Truck Insurance, Makes up for the damages triggered to one more person, their automobile or a third-party home.-Damage triggered due to man-made activities such as troubles, strikes, etc. Home framework insurance coverage This shields the structure of your home from any kind of kinds of threats as well as damages. The cover is also reached the long-term components within your home such as kitchen area and also washroom fittings. Public obligation protection The damages triggered to one more person or their residential or commercial property inside the insured home can also be compensated.

Report this wiki page